KATHMANDU —Growth in Nepal this year will be slower than previously projected due to the impacts of import restrictions, monetary policy tightening, higher inflation, and shrinking government expenditure reflecting lower government revenue, according to the World Bank’s twice-a-year country update.

Released today, the latest Nepal Development Update (April 2023): Fine-Tuning Policy in a Turbulent Environment, projects Nepal’s economy to grow by 4.1 percent in FY23, a downward revision from the October 2022 forecast. Growth is expected to accelerate to 4.9 percent in FY24, supported by the resumption of tourism, growth in remittances, and the gradual easing of monetary policy. However, risks to the outlook are tilted downside and include higher-than-expected inflation, which will dampen consumption and growth, the possible impacts of likely rotations in government officials, and rising inequality from reduced investments in human capital, especially amongst those yet to recover from unemployment following the pandemic.

“Amid measures taken to address pressures on the external sector, the Nepali economy has faced the unintended consequences of slowdown in economic growth and lower fiscal revenue,” said Faris Hadad-Zervos, World Bank Country Director for Maldives, Nepal, and Sri Lanka. “This makes the Government‘s Green, Resilient, and Inclusive Development (GRID) agenda even more pressing.These reforms will yield optimal results as the Government communicates its intended policy changes with the public in advance, takes timely action, and fine-tunes policies during the course of implementation.”

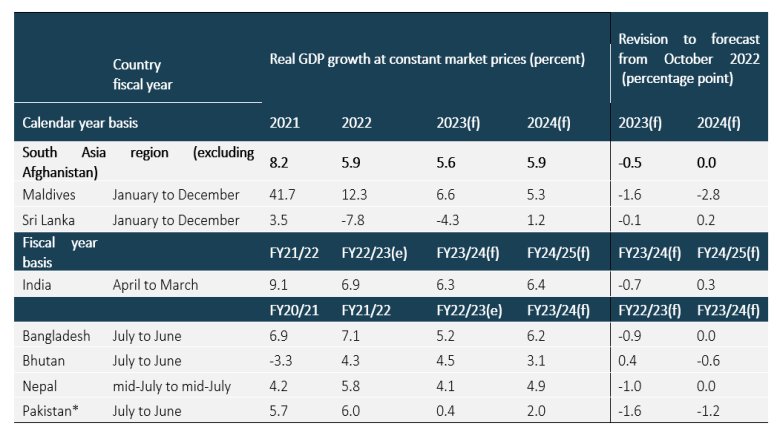

The report is a companion piece to the latest South Asia Economic Focus, Expanding Opportunities: Toward Inclusive Growth, which projects regional growth to average 5.6 percent in 2023, a slight downward revision from the October 2022 forecast. Regional growth is expected to remain moderate to 5.9 percent in 2024, following an initial post-pandemic recovery of 8.2 percent in 2021.

Inflation in South Asia is set to fall to 8.9 percent this year, and to below 7 percent in 2024. However, weaker currencies and delayed domestic price adjustments are contributing to a slower than anticipated decline in inflation. Elevated global and domestic food prices are contributing to greater food insecurity for South Asia’s poor who spend a larger share of income on food.

To move from recovery to sustained growth, South Asia needs to ensure economic development is inclusive. The region has among the world’s highest inequality of opportunity. Between 40 and 60 percent of total inequality in South Asia is driven by circumstances out of an individual’s control such as place of birth, family background, caste, ethnicity, and gender. Intergenerational mobility is also among the world’s lowest. Data highlighted in the report shows that less than 9 percent of individuals whose parents have low levels of education reach education levels of the upper 25 percent. Such disparities lead to differences in access to jobs, earnings, consumption, and welfare and to calls for redistributive policies.

“South Asia’s stark socioeconomic divides are both unfair and inefficient. They keep talented individuals from contributing to society, reduce incentives to invest in human capital, and derail long-term economic growth,” said Hans Timmer, World Bank Chief Economist for South Asia. “Addressing these structural issues is vital to ensuring the region can achieve its full potential.”

The report recommends continuing to improve the quality of primary education and expanding access to secondary and higher education, evaluate and strengthen affirmative action policies targeted to “low opportunity” groups, and policies to improve the business climate for small and medium enterprises, who account for the bulk of job opportunities for the less well-off. In addition, reducing barriers to labor mobility can have a powerful equalizing impact as urban areas tend to offer more opportunities for social mobility.