Panama City. A court in Panama on Friday acquitted 28 people accused of money laundering at Mossack Fonseca, the law firm at the center of the “Panama Papers” international tax fraud scandal.

Jürgen Mossack and Ramon Fonseca, the founders of the company, are among those who have been cleared. Ramon died in a hospital in Panama in May. During the trial held in Panama City last April, the prosecution requested a 12-year prison sentence for both.

But Judge Baloisa Makrvinez acquitted the couple and 26 other people after finding that the evidence taken from the server of the law firm was not collected according to the procedure. “The remaining evidence is not sufficient and decisive to determine the criminal responsibility of the defendants,” the judge said in a statement issued by the court.

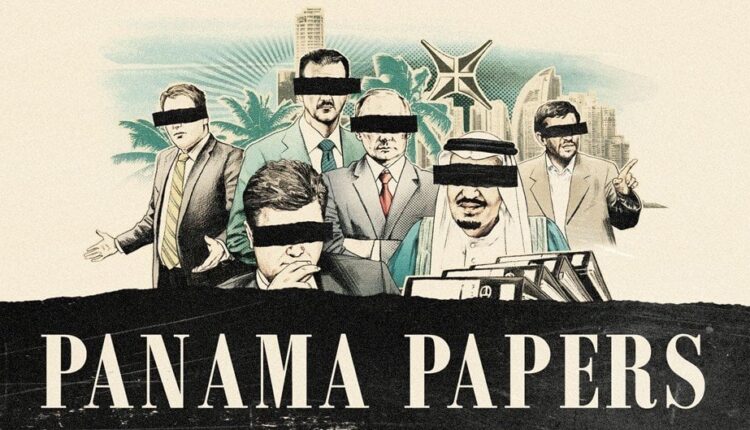

In 2016, leaked documents from Mossack Fonseca revealed how many of the world’s richest people hid their wealth in offshore companies. Former British Prime Minister David Cameron, Russian President Vladimir Putin, football star Lionel Messi, then Argentine President Mauricio Macri and Spanish film producer Pedro Almodóvar were also tried.

Prosecutors in Panama accused Mossack and Fonseca of helping to create opaque companies. Officials of the German multinational Siemens deposited millions of euros in the company outside the official accounts of the company.

They were also accused of helping to launder money from a massive fraud in Argentina. Guillermina MacDonald, a lawyer for Mossack and the other defendants, told AFP: “Justice has been served, we are very satisfied with the judge’s decision.”

He said, “But we are a little sad that we lost Ramon Fonseca during the trial and he could not see the outcome. We are saddened by this.”

The hearing of this case has started eight years after the publication of the Panama Papers on April 3, 2016 by the International Consortium of Investigative Journalists (ICIJ). The investigation, based on 1.15 million documents from Mossack Fonseca, has revealed how personalities around the world have hidden assets, companies, assets and profits to evade taxes or launder money.

According to the research, for this, it is seen that in some cases they have created companies through firms that came from illegal activities, opened bank accounts and created sub-branches (foundations) in many countries to hide money.

The scandal led to the closure of Mossack Fonseca and the international image of Panama as an offshore tax evader. Offshore companies are not in themselves illegal, and there are many legitimate reasons for using them. But they can also be used to launder the proceeds of criminal activity or to hide misused or politically inconvenient assets.

“In reality, there has been a great injustice,” Mossack said after the hearing. “My friends and everyone who worked with me were serious, honest and accurate,” he continued. Agency

Trending Now

- ट्रम्पको कार्यकालमा एप्पलले पाँच खर्ब डलर लगानी गर्ने, थप २० हजारलाई रोजगारी

- नेसनल आईसीटी स्कलरसिप-२०८१’ को आवेदन खुला, २ करोड १३ लाख बराबरको छात्रवृत्ति

- थाइल्यान्डका उद्योगी, व्यवसायीसँग प्रधानमन्त्री ओलीको छलफल, लगानीका लागि आह्वान

- सर्जकहरूलाई सम्मान र पुरस्कारहरूको घोषणा

- NASA unveils new crew for space mission

- More than one lakh tourists came to Nepal in March

- आजदेखि काठमाडौं केन्द्रित आन्दोलन गर्दै शिक्षक महासंघ

- धानमन्त्री केपी शर्मा ओली र उनका थाइ समकक्षी पे थोङ् थान् शिनावातबीच आज भेटवार्ता हुँदै

- पत्रकार रजकलाई गोली नलागेको पुष्टि

- निर्दोष नागरिकमाथि गोली हान्न पाइँदैन, प्रधानमन्त्री र गृहमन्त्रीलाई पक्राउ गर्नुपर्छ : ज्ञानेन्द्र शाही

Comments are closed.